5 Best Forex Trading Platforms

We have listed the 5 Best Forex Trading Platforms for trading a wide range of currency pairs, including major, minor, and exotic pairs. These platforms offer intuitive interfaces, advanced charting tools, and secure execution, ensuring that both beginners and professional traders can efficiently access the forex market and trade with confidence.

5 Best Forex Trading Platforms (2025)

- MetaTrader 4 – Overall, the Best Forex Trading Platform.

- MetaTrader 5 – Built-in economic calendar for fundamental analysis.

- Doto – Modern interface designed for ease of use and efficiency.

- cTrader – Supports automated trading through cAlgo (cTrader Automate).

- TradingView – Alerts and notifications for price movements and technical conditions.

Top 10 Forex Brokers (Globally)

1. MetaTrader 4

MetaTrader 4 (MT4) is widely recognized as one of the most reliable trading platforms worldwide. It combines advanced charting, flexible order execution, and automated trading tools, allowing both beginners and professional traders to execute strategies efficiently while staying connected through desktop, web, and mobile devices.

| Feature | Description | Platforms | Accessibility |

| Trading Instruments | Forex CFDs | Desktop Web Mobile | Global |

| Order Types | Market Pending Stop Trailing | Desktop Mobile | Flexible |

| Technical Tools | 30 Indicators 23 Objects | Desktop Mobile | Customizable |

| Automation | Expert Advisors (EAs) | Desktop | Algorithmic Trading |

Frequently Asked Questions

What types of orders can I place with MetaTrader 4?

MT4 supports multiple execution modes, including 2 market orders, 4 pending orders, 2 stop orders, and trailing stops. These options give traders full control over strategy implementation, ensuring flexibility in both short-term and long-term trading.

Does MetaTrader 4 offer technical analysis tools?

Yes, MT4 provides 30 built-in technical indicators, 23 analytical objects, and access to thousands of custom tools via the Code Base and Market. Traders can combine these tools to perform detailed technical analysis and enhance decision-making.

Pros and Cons

| ✓ Pros | ✕ Cons |

| User-friendly interface | Slightly outdated design |

| Supports automated trading | Limited to forex and CFDs |

| Mobile and desktop compatibility | Fewer native chart types than MT5 |

| Extensive custom indicators | No integrated social trading |

| Flexible order execution | Basic news and economic tools |

Our Insights

MetaTrader 4 remains a top choice for forex and CFD trading. Its comprehensive analytics, automated trading capabilities, flexible execution options, and mobile support make it ideal for all experience levels, empowering traders to navigate markets confidently and efficiently.

Forex Broker offering MetaTrader 4:

★★★★★ | Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes |

2. MetaTrader 5

MetaTrader 5 (MT5) is recognized as a versatile, next-generation trading platform. It supports forex, stocks, and futures while offering advanced order types, multiple execution modes, and Market Depth analysis. Both beginners and professional traders benefit from its extensive charts, indicators, automation tools, and seamless mobile and web access.

| Feature | Description | Platforms | Accessibility |

| Trading Instruments | Forex Stocks Futures | Desktop Web Mobile | Global |

| Order Types | Netting Hedging Market Pending | Desktop Mobile | Flexible |

| Technical Tools | 100 Charts 21 Timeframes 80+ Indicators | Desktop Mobile | Customizable |

| Automation | Expert Advisors via MQL5 | Desktop | Algorithmic Trading |

Frequently Asked Questions

What’s the difference between MT5 and MT4?

MT5 supports more asset classes, additional timeframes, integrated fundamental analysis tools, and an advanced strategy tester. These upgrades provide traders with greater flexibility, better analytics, and enhanced trading efficiency compared to MT4.

Can I automate trades with MT5?

Yes, MT5 allows automated trading via Expert Advisors (EAs) programmed in MQL5. This enables traders to run sophisticated strategies, backtest algorithms, and execute trades without manual intervention.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Multi-asset trading | Can be complex for beginners |

| Advanced analytics and charts | Slightly heavier software |

| Supports algorithmic trading | More features may overwhelm new users |

| Integrated economic calendar | Fewer brokers support MT5 than MT4 |

| Web, desktop, and mobile access | Some third-party apps are paid |

Our Insights

MetaTrader 5 offers a comprehensive, professional-grade trading experience. Its multi-asset support, advanced analytics, automation features, and cross-platform access make it ideal for both discretionary and algorithmic traders, delivering a flexible and scalable solution for modern financial markets.

Forex Broker offering MetaTrader 5:

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

3. Doto

Doto delivers a modern, all-in-one trading platform for CFDs across forex, stocks, crypto, commodities, and indices. It combines high leverage, fast execution, and advanced analytics, giving both beginner and professional traders the tools to plan trades effectively, manage risk, and access global markets with confidence.

| Feature | Description | Platforms | Accessibility |

| Trading Instruments | Forex Stocks Crypto Commodities Indices | Desktop Web Mobile | Global |

| Leverage | Up to 500x | Desktop Mobile | Flexible |

| Trading Tools | Analytics Economic Calendar Stop Loss Take Profit | Desktop Mobile | Real-Time |

| Regulation | 🇿🇦 FSCA 🇲🇺 FSC FinaCom Member | Desktop Mobile | Secure |

Frequently Asked Questions

What types of instruments can I trade on Doto?

Doto offers a wide range of CFDs, including forex, stocks, cryptocurrencies, commodities, and indices. Traders can access both popular and emerging instruments, taking advantage of leverage and tight spreads to maximize trading opportunities across multiple markets.

Is Doto safe and regulated?

Yes, Doto operates under licenses from 🇿🇦 FSCA and 🇲🇺 FSC, with membership in FinaCom providing compensation protection up to €20,000. Client funds are segregated in top-tier banks, and negative balance protection ensures traders never lose more than their account balance.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Offers trading tools like Trading Central signals, economic calendar, and risk controls | Limited base currency options |

| Proprietary platform plus MT4 and MT5 | Swap fees can be expensive for longer-term positions on some instruments |

| Offers forex, stocks, crypto, commodities, indices, ETFs | Not available in major markets like the US, UK, EU, Canada, Australia, and others |

| Low $15 minimum deposit for Standard account | Raw account requires higher $200 minimum deposit |

| Deposit bonus up to 50% on first $1,000 and 20% thereafter (max $5,000) | Inactivity fee of $15 per month after 6 months of inactivity |

Our Insights

Doto combines cutting-edge trading technology, broad CFD access, and robust risk management features. Its strong regulatory oversight, fast execution, and mobile-ready platform make it ideal for traders seeking a secure, flexible, and efficient environment for both manual and automated trading strategies.

Get in Touch with Doto:

★★★★★ | Minimum Deposit: $15 Regulated by: CySEC, FSC, FSCA, FSA Crypto: Yes |

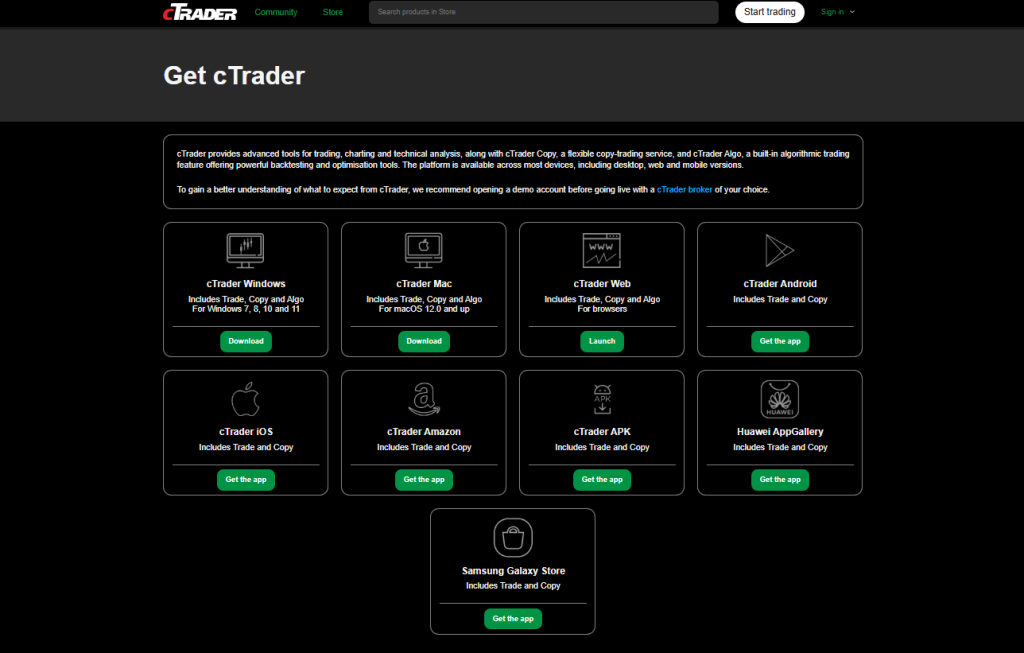

4. cTrader

cTrader is a premium trading platform designed for forex and CFD traders seeking speed, precision, and customization. It offers advanced charting, Level 2 pricing, multiple order types, and automation capabilities, enabling both beginners and professional traders to execute strategies efficiently across desktop, web, and mobile.

| Feature | Description | Platforms | Accessibility |

| Trading Instruments | Forex CFDs | Desktop Web Mobile | Global |

| Order Types | Market Pending Stop Advanced | Desktop Mobile | Flexible |

| Automation | cTrader Algo Open API FIX API | Desktop | Algorithmic Trading |

| Copy Trading | cTrader Copy | Desktop Mobile | Real-Time |

Frequently Asked Questions

What makes cTrader different from other trading platforms?

cTrader provides Level 2 pricing, advanced order types, and access to the FIX API and Open API for free. This transparency and customizability give traders more control, making it easier to develop strategies, execute trades, and manage risk effectively.

Can I automate trades on cTrader?

Yes, cTrader supports automation via cTrader Algo. Traders can develop, test, and deploy trading bots using C#, allowing algorithmic strategies to run efficiently alongside manual trading approaches.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Advanced charting tools | Steeper learning curve for beginners |

| Level 2 pricing | Limited broker availability |

| Automation with C# | No native social trading community |

| Copy trading feature | Fewer integrated fundamental tools |

| Web, desktop, and mobile access | Can be resource-heavy on older devices |

Our Insights

cTrader delivers a high-performance, flexible trading ecosystem. Its combination of advanced charting, automation tools, copy trading, and developer-friendly APIs makes it ideal for manual and algorithmic traders, providing a professional-grade platform that adapts to a wide range of trading styles.

Forex Broker offering cTrader:

★★★★ | Minimum Deposit: $0 Regulated by: FMA Crypto: Yes |

TradingView

TradingView is a globally recognized charting platform that combines powerful technical tools with a vibrant social network. Supporting stocks, crypto, forex, and indices, it allows traders to analyze markets, share ideas, and execute trades directly with supported brokers, making it ideal for both beginners and professionals.

| Feature | Description | Platforms | Accessibility |

| Trading Instruments | Stocks Forex Crypto Indices | Desktop Web Mobile | Global |

| Charting Tools | Real-time charts Pine Script indicators | Desktop Web Mobile | Customizable |

| Social Trading | Community ideas and collaboration | Desktop Web Mobile | Real-Time |

| Broker Integration | Direct trading via supported brokers | Desktop Web Mobile | Seamless |

Frequently Asked Questions

Is TradingView free to use?

Yes, TradingView offers a free plan with access to charts and basic indicators. Advanced tools and additional features are available through Pro, Pro+, or Premium subscriptions, providing traders with more analytical flexibility and customizability.

Can I trade directly on TradingView?

Yes, TradingView integrates with multiple brokers, allowing users to place trades directly from the chart interface. This enables seamless execution while using TradingView’s advanced charting, indicators, and alerts for real-time decision-making.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Powerful charting tools | Advanced features require paid plans |

| Community-driven insights | Direct trading limited to supported brokers |

| Supports multiple asset classes | No built-in execution for all markets |

| Cross-device access | Can be overwhelming for beginners |

| Customizable indicators via Pine Script | Social features may distract |

Our Insights

TradingView combines world-class charting with a social, community-driven environment. Its cross-device access, Pine Script customizations, and broker integrations make it ideal for both analysis and trading, offering a flexible, collaborative, and visually intuitive experience for traders of all levels.

Forex Broker offering TradingView:

★★★★ | Minimum Deposit: $0 Regulated by: SEC, FINRA, FCA, ASIC Crypto: No |

What is a Forex Trading Platform?

A Forex trading platform is a digital software that connects traders to the currency market, enabling them to buy and sell currency pairs online. It provides tools like live price feeds, advanced charting, technical indicators, and execution features.

Platforms also offer risk management tools, mobile access, and integrations with brokers, making trading fast, transparent, and efficient.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Real-time market data | Learning curve for beginners |

| Advanced charting tools | Subscription costs for premium features |

| Automated trading options | Requires stable internet connection |

| Accessible via web and mobile | Complex setups for advanced tools |

| Integration with multiple brokers | Broker compatibility limitations |

You might also like:

In Conclusion

Forex trading platforms act as the gateway to global markets. They simplify access, provide powerful tools, and cater to both beginners and professionals. Choosing the right platform ensures better execution, smooth trading, and improved decision-making.

Faq

It connects traders to the forex market and provides tools to analyze, place, and manage trades.

Many offer free versions, but advanced features may require a paid subscription or broker account.

Yes, some platforms support multi-broker connections, but others are broker-specific.

Yes, most major platforms support trading bots, scripts, or algorithmic strategies.

MetaTrader 4 and TradingView are popular beginner-friendly choices due to ease of use and wide support.